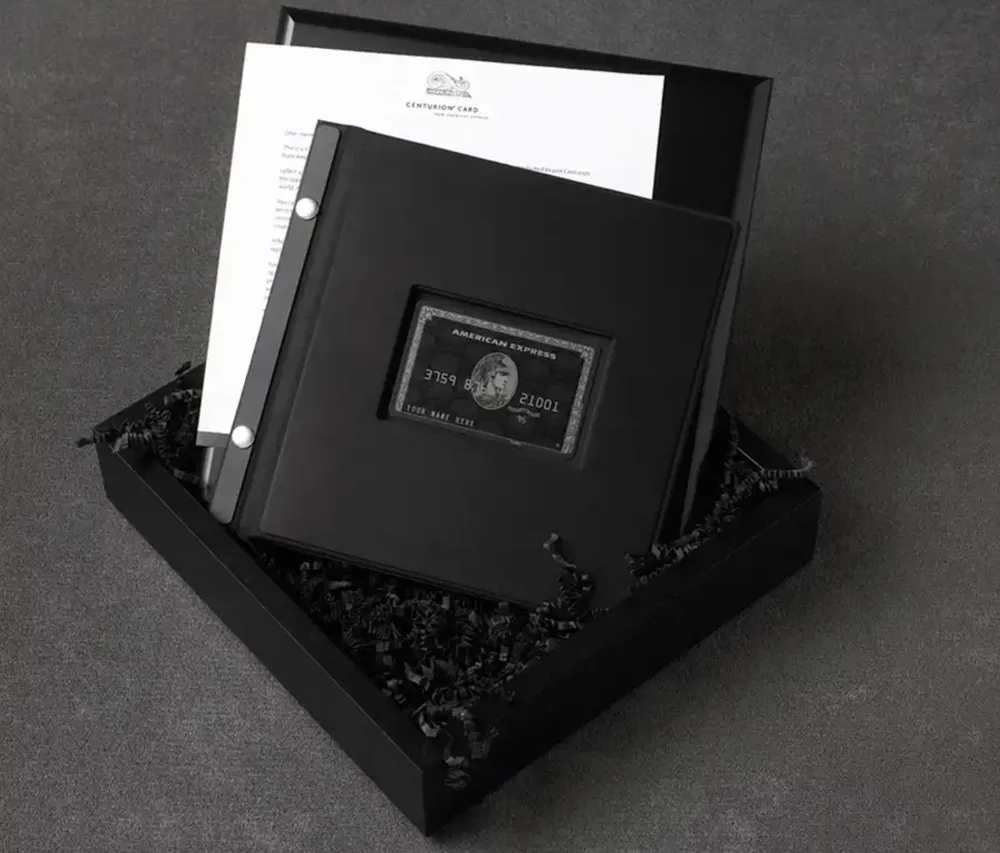

The Centurion Card, also known as the Black Card, is a charge card issued by American Express. This card was created in 1999 with the purpose of rewarding and distinguishing the clients of American Express's Premium, Gold, and Platinum cards. Since its launch, it has been considered one of the most exclusive and prestigious cards in the world, offering its holders access to unique experiences and elite services. The legend about its existence began in the late 80s and early 90s and was passed around as an urban legend before its official release.

How to get Centurion Card

For those of you looking for how to get a Centurion card in 3 months, we're sorry to say that it's not that easy, unless you already have a relationship with American Express and are on the Forbes list.

The American Express Centurion Black Card, often referred to as the Black Card, is by invitation only. This means you can't directly apply for the credit card, emphasizing its exclusivity.

1. Be an Existing Amex Cardholder with Good Financial Health:

- One of the primary requirements to get the Centurion card is to be an existing Amex cardholder in good standing. This means that if you've had any delinquencies or bankruptcies with Amex, your chances of getting the Centurion card are slim.

- At a minimum, you should have a history with Amex for at least 1 year. Even if you're a significant spender with other card providers, you'll need to establish a relationship with Amex, potentially with cards like the Amex Platinum or Amex Business Platinum.

2. Make at Least $250,000 in Purchases on Your Amex Cards:

- While Amex doesn't officially publish a spending threshold for an invitation, a general guideline is that you should make at least $250,000 in annual purchases across all your Amex cards.

- For instance, if you spend $150,000 on your Amex Platinum card and $200,000 on your American Express® Gold Card per year, your combined spending across these two cards would be around $350,000.

- It's worth noting that spending $250,000 per year doesn't guarantee an invitation. Rumors suggest that the range could be anywhere from $250,000 to $500,000 in annual purchases. The spending requirements might also vary based on the specific card product you're aiming for. For instance, the Centurion card might require around $250,000 to $350,000 in annual spending, while the Business Centurion® Card from American Express might require around $400,000 to $500,000 in annual spending.

It's essential to understand that these are general guidelines and not strict rules. The actual criteria for an invitation to the Centurion card club might vary and are not publicly disclosed by American Express. The Centurion card is known for its exclusivity, and meeting the above criteria doesn't guarantee an invitation.

Benefits

The Centurion Card from American Express, often referred to as the AMEX Black Card, offers a range of benefits for its cardholders. Here are the benefits of the Centurion Card:

Airline and Airport Perks:

- Complimentary upgrades and priority wait-listing for air travel.

- Automatic Delta SkyMiles Platinum Medallion status, which includes complimentary upgrades, priority waitlisting, priority boarding, and more.

- Exclusive airport perks not found with other cards.

- Personal airport guide for first or business class travelers on international flights to assist with customs.

- Arrangement of ground transportation by American Express.

- Access to Centurion Lounges in more than 140 international airports worldwide, including Dallas/Worth, Las Vegas, Miami, New York LaGuardia, Seattle, San Francisco, and Houston airports in the USA. These also include Chhatrapati Shivaji International Airport (BOM) in Mumbai, India; Hong Kong International Airport (HKG) in Hong Kong; and Indira Gandhi International Airport (DEL) in Delhi, India. In Europe, there's a lounge at London Heathrow Airport (LHR) in England and another at Stockholm Arlanda Airport (ARN), in Sweden. Travelers in South America can visit the lounge at Aeroporto Internacional de São Paulo (GRU) in Brazil and the Ezeiza International Airport (EZE) in Buenos Aires, Argentina. In Australia, lounges are located at both Tullamarine Airport (MEL) in Melbourne and Sydney Kingsford Smith Airport (SYD). Lastly, in Mexico, there are lounges at the General Mariano Escobedo Airport (MTY) in Monterrey and the Benito Juárez International Airport (MEX) in Mexico City. You can find all the VIP Lounges in the AMEX website.

- Complimentary membership to PS LAX, an exclusive space for Centurion cardholders.

- Priority Pass Select, offering unlimited lounge access for cardholders and their guests at hundreds of airport lounges globally.

- Fee credit for Global Entry or TSA PreCheck application every 5 years.

Hotel Benefits:

- Elite status at renowned hotels and resorts worldwide, including Marriott Gold Elite status, Hilton Honors Diamond, and IHG Priority Club Rewards Platinum Elite.

- Access to the Centurion Hotel Program and AMEX Fine Hotels & Resorts, which offer benefits like daily breakfast for two, room upgrades, guaranteed 4 pm checkout, and in-room WiFi.

Car Rental and Auto Advantages:

- Elite status in two car rental programs: Avis President’s Club and Hertz Platinum.

- Access to the Centurion Auto Program, which offers premium vehicle purchasing, luxury rentals, and unique driving experiences.

- Primary rental car insurance and premium roadside assistance.

Other Luxury Benefits:

- Access to exclusive sales and events such as the Kentucky Derby, Wimbledon Club Experience, and the Grand Prix de Monaco.

- Shopping and dining perks.

- 24/7 personal Centurion concierge service.

- Centurion Dining Program, which reserves a table for cardmembers daily at top global restaurants.

- Centurion Wine and Wine Buying benefit, offering access to private tastings and tours in Napa, California.

- Discounts and perks for cruises.

- Benefits at SoulCycle, including complimentary classes, fast track to SuperSoul status, free passes for friends, and retail perks.

For business owners and entrepreneurs, the Centurion Card offers a suite of benefits tailored to their unique needs. One of the standout features is access to the AMEX Open Forum. This platform serves as an online community where business owners can connect, share insights, and learn from one another. It's a valuable resource for networking and gaining industry knowledge. Additionally, cardholders can enroll in the FX International Payments program. This service is particularly beneficial for businesses that deal with international transactions. By enrolling, they can waive transaction fees on eligible foreign currency payments, potentially saving significant amounts in the long run.

And the@AmericanExpress Centurion is perhaps the most prestigious card in the world.

— Xavier Tello, MD (@StratCons) August 10, 2019

It represents the highest economic power, full of benefits and with which many F1 tickets will surely be paid for.

Paradoxically, it is... black.

In your face #Pigmentocracy !!! pic.twitter.com/wBJLMnVKna

The Centurion Card doesn't just offer luxury and travel benefits; it also provides a layer of protection for its cardholders. Purchases made with the card come with added security, including purchase protection, return protection, and an extended warranty. This means that if you buy an item and it gets damaged or stolen, or if you change your mind about a purchase, the card's protections can come into play. Additionally, when traveling, cardholders can have peace of mind knowing they are covered with baggage insurance and travel accident insurance. And for those who rent cars, the card offers rental car insurance, ensuring that you're protected on the road.

It should be remembered that the Centurion card is by invitation only and has an annual fee of $5,000 and an initiation fee of $10,000. The card gives 1 point per dollar spent, but the real value lies in its extensive list of benefits. If you are interested in finding out how much it costs to issue a Centurion card in your country, here are the details.

Prices and fees

Prices and currency exchange rates as of September 2023

| Country | Annual Fee | One-time Fee |

|---|---|---|

| United States | US$5,000 | US$10,000 |

| United Kingdom | £3,400 (US$4,229.24) | £3,400 (US$4,229.24) |

| Canada | Can$2,500 (US$1,843.75) | Can$5,000 (US$3,687.50) |

| India | ₹236,000 (US$2,842.72) | ₹836,000 with GST (US$10,080.64) |

| France, Spain, Belgium, Italy, Netherlands | €3,000 (US$3,219.68) | €3,000 (US$3,219.68) |

| Germany, Austria | €5,000 (US$5,366.13) | €5,000 (US$5,366.13) |

| Switzerland | SFr 4,200 (US$4,709.84) | N/A |

| Australia | A$5,000 (US$3,205.13) | A$5,000 (US$3,205.13) |

| Japan | ¥365,000 (US$2,478.26) | N/A |

| Hong Kong | HK$38,800 (US$4,960.00) | HK$19,800 (US$2,530.00) |

| South Korea (Republic of Korea) | ₩3,000,000 (US$2,253.52) | N/A |

| China (People's Republic of China) | RMB 18,000 or RMB 36,000 (US$2,471.91 or US$4,943.82) | N/A |

| Singapore | S$7,490 (US$5,503.71) | S$7,490 (US$5,503.71) |

| Kuwait | US$4,000 | N/A |

| Mexico | Mex$56,000 (US$3,245.90) | N/A |

| Brazil | R$10,000 (US$2,020.20) | N/A |

| Argentina | ARS $388,320 (US$1,110.11) | N/A |

| Saudi Arabia | SRls 17,250 (US$4,600) | SRls 17,250 (US$4,600) |

| International Dollar Currency Card (IDC) | US$3,000 | US$5,000 |

| International Currency Card Euro (ICC Euro) | €4,000 (US$4,287.58) | €4,000 (US$4,287.58) |

| International Currency Card Dollar (ICC Dollar) | US$4,000 | US$4,000 |

| Israel | US$2,043 | N/A |

| Turkey | ₺19,000 (US$2,147) | N/A |

| Taiwan | NT$160,000 (US$5,728) | NT$160,000 (US$5,728) |

| Lebanon | LL 3,000 (US$3,000) | N/A |

| United Arab Emirates | Dhs. 11,000 (US$3,000) | N/A |

| Sweden | SKr 35,000 (US$4,079) | SKr 35,000 (US$4,079) |

The International Euro (IEC) or Dollar (IDC) are the currencies used for the Centurion card issued by Amex in the United Kingdom for clients in Europe, the Middle East, and Africa. Up to 22 cards are offered as part of the annual fee, including a titanium Centurion card for the primary cardholder, an additional black plastic card for the main cardholders, a black plastic Centurion card for a family member, and up to 19 supplementary cards in green, gold, or platinum for family members.

As we can see in this table, Taiwan stands out as the country with the highest annual fee for the Centurion Card by American Express. When converted to USD, the fee in Taiwan is a staggering US$5,728. Following closely behind is Hong Kong, where cardholders are required to pay an annual fee equivalent to US$4,994. Switzerland also ranks among the top, with an annual fee conversion amounting to US$4,709.84. These figures highlight the premium nature of the Centurion Card and the significant investment required by cardholders in these regions.

How many black american express cards are there

The number of Black American Express Cards in circulation is a closely guarded secret, known only to American Express itself. These exclusive cards, often seen as a symbol of elite financial status, are offered by invitation only to high-net-worth individuals who meet undisclosed criteria. American Express has not publicly disclosed the exact number of Black Cards in existence. This air of mystery and exclusivity adds to the allure of the Black Card, making it one of the most coveted credit cards in the world. If you're interested in the current status or eligibility for obtaining one, it's best to reach out to American Express directly for the latest information.

Is It Really Worth It?

The Centurion Card from American Express, commonly known as the "Black Card," is more than just a credit card; it's a symbol of status and exclusivity. If you move in luxury circles, this card is an indispensable tool.

Exclusivity: The Centurion is offered by invitation only to a select group, ensuring a level of distinction that other cards can't match.

Benefits: Cardholders enjoy unique privileges such as access to airport VIP lounges, 24/7 personal concierge service, hotel and airline upgrades, and exclusive experiences.

Examples of Use:

- Travel: Imagine flying first class and upon landing, a driver takes you to a 5-star hotel where you've been upgraded to the presidential suite.

- Exclusive Events: Attend a movie premiere or have a front-row seat at a fashion show with the Centurion.

- Luxury Shopping: Want to buy a Patek Philippe watch? With the Centurion, you could have access to exclusive models or even private brand events.

- Maritime Experiences: Reserve a yacht at the Campomanes marina for an unforgettable weekend sailing the Mediterranean.

- Exclusive Transportation: Need to get to your home in Altea Hills quickly? Rent a helicopter to drop you off at your residence's doorstep.

First Villa with Private Helipad on the Costa Blanca

540m2 | Bedrooms: 3 | Bathrooms: 4

In summary, if you value exclusivity, comfort, and premium benefits, the Centurion Card is more than a card; it's a key to a world of luxury and unique experiences. It's ideal for those not just looking for transactions, but exceptional experiences.